The largest I have received so far from C2C was $90.

I completely understand that the lower fees is out of grounds for many signing agents. C2C have never gave me a bad experience yet and If I find their fees too low which happens often then I just ignore the fee.

I have not accepted a signing from them yet but intend to as soon as I receive a notice that does not conflict and is satisfactory in payment. I am sure they understand that. Lisa and Toni were very helpful with attaining my Fidelity approval. No one else would do what they did. That to me, states a lot about them. I am sure that if a fee is insufficient. like everyone else, they understand negotiable.

$150. The most recently I negotiated for a $200 job last Friday but I had to decline because the time the borrower needed wasn’t feasible for me. I’d say my average with C2C has been around $100 and I make sure the job coincided with the pay for my time etc. I really enjoy working with C2C and they have been very good to me. Communication and negotiation on fees is key for any signing service we work with. I find the few times I’ve communicated with the owner Lisa she has been so professional, quick to respond to my questions and a very conscientious business owner. You have to remember part of working with a signing service is they are bringing you the work vs you going out and marketing yourself directly with Lenders, Title Companys, Escrow Officers etc. So it’s a trade off. If you want more money than you need go and work direct, build up and earn your own reputation to be on their team.

Even though I fear of being blacklisted from C2C, I must state that the average signing I see from them is $50 for HELOCs and $75 for Refi’s. When they get no takers and are desperate, then the fee goes up. I just saw a ridiculous one for a Reverse Mort Application for $60 from C2C. Those applications take way too long, as the notary is dealing with older people. I’m not discriminating, but pointing to the fact that usually Rev Mort take longer than a regular refi or HELOC because the signers are older folks, with less dexterity. But $60 Lisa? I don’t think I have ever gotten more than $90 from them.

Anyhow, I still like them as they offer a lot of business opportunities.

I do a lot of work for C to C here in Seattle. The fees are fair and reasonable. The volume of work (and it includes several signing companies)and signings prominity to my home around here is so abundant the fees are really irrelevant. I enjoy what I do and dont take anything out of my comfort zone. The occasional higher fees reflect that as a natural recourse for a full day of helping people get their loans refinanced, purchasing, selling, cash outs, you name it. Focus on the customer, doing a good job and enjoying what you do and watch how your business takes off:)

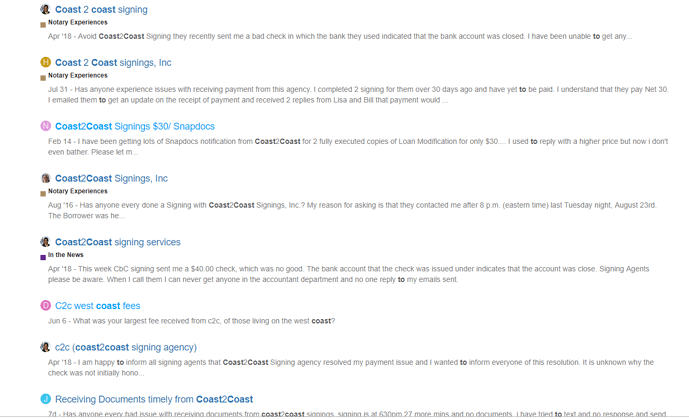

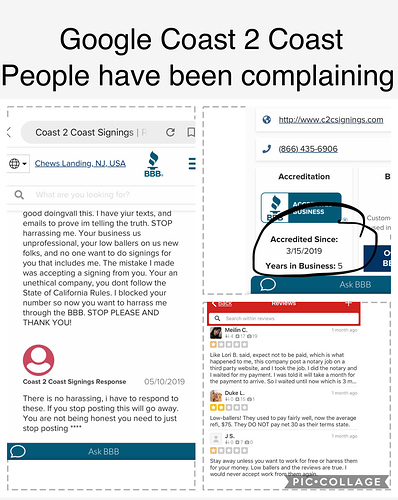

This just shows how C2C Reputation, numbers do not lie. But Lisa will try to convince you otherwise. She will even give you just the signatures to sign and then have her ppl print the rest. Then once you negotiate a higher price she will wait till you complete the job and not pay you. Do as others advise and do not work for this disgusting company.

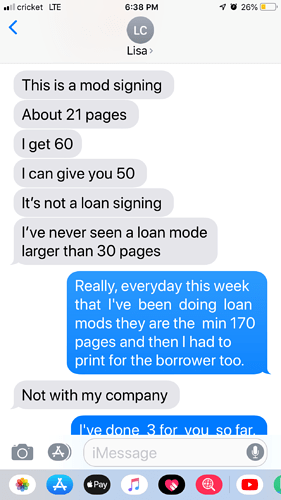

LiSA/C2C will only pays $30-$50 for loan mods. Don’t get suckered into the web of lies.

I tried getting more like she claims she does.

However,do your research and read what other notaries rate this disgusting excuse of a signing company.

This is just one screen shot, I could post what others around the Coast are saying from East to West coast.

anyone with experience with signing companies will tell you, C2C is not the one to be trusted.

Do as you please but know you were warned.These are just some responses from Yelp, BBB, and it says she has only been in business for 5 years as accredited. So do what you want you are grown but…

She will justify her wrong doing and play a victim, like a villain does.

I am not scared of her, only reason she has so much heart is because she’s on the West Coast and a cyber bully.

Yes, Lisa is highly unprofessional. She needs to get back out in the field and do the signings herself.

She is too old to go back and forth with people. This is why it is so hard for her to find ppl.

you will not find any other signing company in any other forum trying to defend themselves, they are too busy making money and building beautiful relationships with notaries.

I have never seen a loan mod at 170 pages but have definitely seen them on a wild scale between 30-70 pages. In many cases you have to print 3 copies so it adds up. I charge $65 for a loan mod and typically only do them in my immediate area. I have helped out one of my regulars before that paid extra for me to do a little distance.

My tip of the day BEWARE of negative feed back to Lisa/C2C she will bash you in the back office on Snapdocs and you will not be able to see it per Snapdocs policy you will just never get jobs accepted again from Snapdocs clients and be left wondering why. A LAWSUIT against both Snapdocs and C2C/Lisa is the only way to get your reputation back. Both costing lots of time and money. There are many other very reputable companies to work with with 100% less drama that are not part of the Snapdocs drama. Some of us take our business very seriously, it is our lively hood and do our best only to get kicked in the teeth and stabbed in the back from less reputable companies. Seek out companies who will treat you right and do a great job for them. Don’t sweat the small stuff!

Low-ballers and take forever to pay. I did about 20 for them and can’t keep doing it for those amounts. I am losing $

Lisa is as rude as they come. They are very unprofessional and will cheat you the first opportunity they get. I did a signing for them and they tried to sneak in a second signing; same signing location but different borrower for a different property. They were not offering any additional fee. Also, they didn’t tell me in advance; just sent additional docs. No chance!

I shipped docs same day & got a receipt from FedEx (as I’ve learned to ALWAYS do). The time stamp on my receipt clearly showed they were dropped prior to cut off time but Lisa claimed FedEx didn’t get them out same day despite my receipt. She cut my pay in HALF!! I still don’t believe her since 3 years laterite never happened again.

As if that wasn’t enough, I had to go through silly nonsense to get paid at all. I blocked them on SnapDocs. I blocked their @c2csignings.com from emailing me & I blocked their phone # from calling me. They are the ONLY company I’ve blocked but Lisa is belligerent and a sneaky thief!

I have to say… that I agree about the reverse mortgage applications… C2C gets paid $50-65 from most of our clients… we lost money on the applications…

we are renegotiating these prices now and hope to pay a better fee

I agree with you

Lisa

Rena, we do not cheat anyone, what you are saying here is liable

you might consider different wording “Lisa is belligerent and a sneaky thief!” is actionable.

Lisa Bittner

I understand, please give me a call so I can increase your fees

909-525-8221

Lisa

What your saying is wrong.

a lawsuit for what?

How is bashing C2C and myself on this forum and other notary signing agent forum ok? But if a signing company or escrow companies puts a negative feedback on Snapdocs it’s actionable?

No negative feedback is placed on SnapDocs that has no proof of an error.

We don’t spend time adding feedback for fun, or because we are “getting back” at anyone.

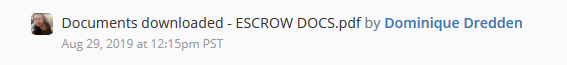

A signing agent last month end, went to a signing, but instead of printing a borrower copy, she printed 1 copy and gave the signer the pages where there had no signatures, and shipped back the pages with signatures.

This is the kind of thing that gets a negative feed back, and deactivation.

And for those that would say “she is new that is not true” she is not a new signing agent.

When you take your business seriously you say your peace and move on, you don’t make it your business to continue to bash a company who NEVER cheated you and always paid you on time and for all signings you ever did and average fee of over $90.00 and above.

but you continue to bash my company and tell others to sue us… good job!

Dominique, you went to a signing, and sent back only signature pages of loan docs.

That was shocking to the escrow agent, who had to spend time reprinting docs and feathering them in at month end.

As far as being too old… how would you know how old I am?

Smart owners will defend comments that are untrue

C2C is not perfect, and there are times we make mistakes, but my phone is the same number for 19 plus years, I do answer my phone calls almost every time.

or call back quickly

Like many of us, we have business we cherish, we have family and friends who bring us joy.

We also have tragedy’s that happen in our lives, we just never know what someone is going through.

I have seen my brother commit suicide a few years ago, a dear friend of mine had a stroke at 50 a month ago.

We have a very good signing agent fighting for her life.

All this negative untruths are so depressing.

I give my phone number out so that if someone feels there is an issue I try to help.

Lisa

I am a mentor to so many people. you were one who I tried to help,

Dominique, you took a short cut, and cant take ownership of it so you are bashing me.

If anyone does not like me as an individul you dont know me, you dont know who I am in my core.

Dominique our loan mods are 9-32 pages

90 percent are 21 pages and you only have to sign 1 set of them

there are some needing two sets but those are much more than 19 pages.

I dont know who you did loan mods for at 170 pages but it was not us.

131 total pages and you sent back 30 signature pages only.

I don’t know what your talking about.

“She will even give you just the signatures to sign and then have her ppl print the rest”

C2C nor myself has never done this.

we sent you the full packages and you returned signature pages.

You did a total of 5 signings with C2C this was the last one.