This is interesting and new to me, as I have always known about the barcodes, but the borrower (supposedly) receiving an exact identical copy of your docs, what’s the purpose for the different barcode on the signers copy if they are in fact true, identical copies of what you have? What if the signer makes an error on one of your pages and you have to ask them for their copy of the same page to correct it? Are you asked to print 2 sets of your copy in addition to the borrower having theirs?

The instructions I have recieved on the Idaho Housing and Wells Fargo Modification account specifically state the clients documents may have different bar codes. I am guessing they probably create multiple modifications for the client for different months behind - awaiting them to contact or sign themProcessing: Modification instructions_000257.jpg…. So the terms may not be the same or bar codes may be different. I will attach a jpeg

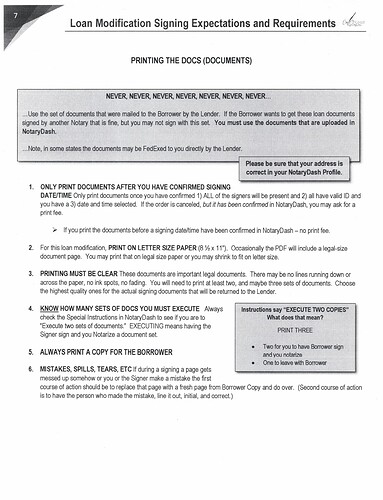

Thanks for the info, as it definitely cleared up my concerns. It also answered my question on the error correction thing as it does instruct you to print a second set of docs for such cases. Good post!

I put the signers’ unsigned copy in a manilla envelope. I tell them, we can only have one real, notorized original. If you notorize a copy, it must be labeled as such. If they have a problem with any of the terms or wording on the documents, stop. You job is not the documents. It is to notorize the signature.

And save your manila folder money. I’ve never used a folder, envelope or even a binder clip on the signer’s copy set of documents. I put the Note, TD, Closing Statement and RTC forms on the top of their stack and I hand it to them at the conclusion of the session. I warmly congratulate them on the closing of their transaction, remind them that if they need a notary, I’m their guy, and I walk briskly to my car.

Oh, by the way, I NEVER notarize any document other than those in the master set that I am turning in to title/escrow/lender. If the client has non-loan transaction documents they want notarized before I go, that’s a different deal and I follow my standard GNW practices and charge accordingly.

Thank you and goodnight. ![]()

@Bobby-CA to clarify for other’s concerns (and mine). if the borrower asked you to notarize their copy for an extra fee (regardless of who pays), would you not do it while breaking out that “COPY” stamp? If not, why? Thanks!

Good idea and good advice. I use binder clips (from dollar tree) on originals and a manilla envelope (buy in bulk), just because spending that extra 50 cents prevents disaster from mixing pages, dropping the pile, fewer mixups when printing, and a neater tote. I have a slight tremor and tend to drop things. Hate the 200 page pickup. To each his own. People seem to appreciate the neat way i give them their pile. I have had return calls to notorize other personal documents for them too!! Tape your card to the envelope.

What do you mean good night? Isn’t it like 2PM by you? ![]()

(CA) The way I see it, I’m working for the agency that assigned me and I’m only gonna notarize what they authorized in the package instructions and/or through the signing service, et.al. If, during the signing session, the signers call and get authorization for an additional notarization from the issuer whilst I’m present, I’ll do it, and probably ask for a $15 fee per signature (California’s permissible fee). I’d stamp the documents as “COPY” accordingly.

I’d welcome supported opposing views that would help me do the job better. ![]()

Sounds reasonable to me. Thanks for the reply!

You are abbalootely correct. I always say that one should do what works best and keeps all the participants happy. Not my place to scold anyone’s methods, especially when they work!

Wow, is it only 2pm? Feels like I’ve been at this keyboard for 2 days!

I have gotten this request only a handful of times. I always tell the signers that I will put their requests in my closing notes to the agency that “the borrowers would like a fully executed copy of the loan package”, and I leave it at that. I have never gotten any pushback.

That’s another good way of handling that eventuality.

This topic was automatically closed after 90 days. New replies are no longer allowed.