@notarynearme You’re kind & thoughtful to post your discovery.

======

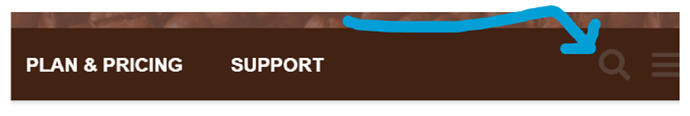

NOTE: You may find it helpful to research the Notary Cafe database that contains a gold mine of helpful elucidating information & data. It echoes around this forum that the magical Magnifying Glass for utilizing & accessing the Search function is IMPOSSIBLE to locate on the Notary Cafe website. So, here is an image to help guide you to find it:

======

The update for the Federal Mileage Deduction Rate was previously posted on 11JUN22 by @LindaH-FL that includes a direct url reference to the official IRS Bulletin announcement & 14JUN22 by @RiverpointeTax => See the threads that follow for more information that was gleaned from the Notary Cafe database:

![]()