For determining the following data:

- How much of the signing agent/notary income is exempt and how much to claim

- How much you can contribute to a 401k (which is structurally different and taxed differently from an IRA)

You’ll best be served by reaching out to a professional tax accountant and/or CPA. This is the optimum route for making the determination.

======

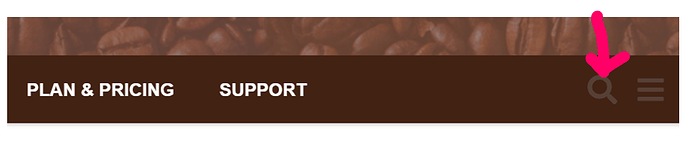

Further, the Search function is being identified to be of assistance to you. ![]()

Each of us contributes our time-proven experience & expertise. We are very busy business owners; either working with clients OR marketing/developing our business. => Our contributions/answers are provided on a voluntary basis and are offered to be of assistance & provide insight to others in this business sector.

It’s so important for each member to endeavor to perform due diligence prior to requesting the valuable time of other business owners.

As a fellow business owner , I’d like to offer an opportunity to further enhance your business acumen & skill set (speaking proverbially ) by “teaching you how to fish;” instead of giving you a fish . . .

Searching the Notary Café database for the answer (that’s more than likely already present) prior to creating a new thread or post is being considerate, thoughtful, & respectful of other members. Saves everyone time & prevents consternation. ![]()

======

You can run a Search (upper right/magnifying glass) as it will usually be quicker than waiting for someone to reply.

Here are the results I found for you by typing “exempt taxes” in the Search field. This page is replete with threads packed with information on how to proceed in your scenario:

https://forum.notarycafe.com/search?q=exempt%20taxes

Also, this thread you may find particularly helpful:

Best Wishes. ![]()