I am located in NJ. The last few signing offers I have received have been for "Texas Cash Out (A6). How is this different then a simple refinance, and are the documents significantly different?

@Bridgit.securedsignatures Great question!

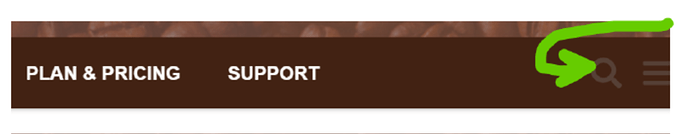

There are many answers already present within the Notary Cafe database on this topic. You can unlock & access the wisdom of the sages & other members as well when you utilize the Search Function. Although, it’s a SECRET & nearly “impossible” to find!

Here’s an image that hopefully will be helpful:

Also, to get you started . . . here is a direct url link to the search results I was able to access for you within the Notary Cafe database:

https://forum.notarycafe.com/search?q=texas%20cash%20out

![]()

The documents are fairly the same as a refinance. The only difference is that a Tx Cashout needs to close in a title or attorney office and you will need to pay them a room fee. In my experience room fees can range from $25 - $100. Last year I was paid an average of $250 for this type of closing. Now i see them as low as $100.

Keep this in mind when you accept this type of closing to determine your fee.

The Texas Equity Refi rules that require closing in a Law Office, Title Office, or Lender’s Office apply only to Homestead properties. Equity Refis on investment properties or non-Homstead properties can be signed anywhere.