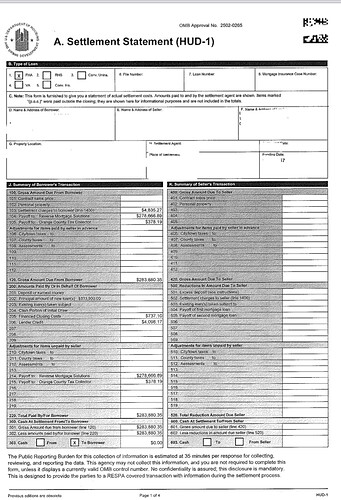

I have yet to do one and I can honestly say I’m a little scared lol. The packages are so big! What should you expect (time wise) with a reverse mortgage? Do the seniors know what to expect at closing as they need to be counseled on this type of loan? And this may sound stupid but how do I explain the HUD statement? Are they only receiving credit?

If you do it right, it doesn’t take any more time than the average refi. First, they’ve already been counseled near to tears AND have already received copies of what they will be signing on the final when the application was done. And you’ll have yet another copy of the final for them. They get it…all you need to do is get it signed. I have found that most really don’t want to go over everything AGAIN, they just want it done.

This was really helpful thank you

If the title company requests that you gather specific copies of documents from the Borrowers, it would be wise to ensure during your confirmation call with them that they locate those docs ahead of time. They’ll need to make copies of them for the title company.

In my experience, there have been a few instances that the Borrowers didn’t locate the docs ahead of time and didn’t make copies. So, time was expended during the signing appointment to accomplish it.

That seems to happen on the Application signing…and I agree that during the confirmation call to the B that you should emphasize that the ‘required copies be available upon your arrival’ (works most of the time…)

I still haven’t done one @dfwtexasnotary but I’m reading the inputs from @Arichter and @cNsa5 … and to be honest the way is being explained here looks simple, just as any refinance. I have read that is “frightening and difficult”

I have done them year are so age, The time it take me to do one Rev Mortgage

I could have done two refi’s good luck!!

Key words: do it right and they go pretty quick.

Okay so here’s my take on HECM or Reverse Mortgages.

The packages are large, between 230-280 pages depending on the lender. Check your instructions, because Sometimes you’re not required to print two copies. Most of the signatures, dates and notarizations will take place in the first 100 pages (not in all cases) and you should see a page or section that indicates the borrowers copies (again, not in all but most cases).

As @Arichter said treat it as a normal refinance. As @cNsa5 said you will have to gather specific documents from the borrower, but that’s generally on the application side. Remember you’re Not their counselor, if they have specific questions pause the signing, make the call to the designated person to get the question answered promptly and correctly. As @Arichter said, in most cases they have been counseled near to tears and just want this process over and done with.

Remember there are no stupid questions… (well, not in this case  )

)

Wishing you many successful signing

100 notarizations???

No…not a 100 notarizations, OMG I would die

. (I’m laughing thinking of what I would charge for 100 notarizations

. (I’m laughing thinking of what I would charge for 100 notarizations  ) The first 100 pages are the one’s which are most likely to require the borrower to sign and date something or for the signing agent to notarize something.

) The first 100 pages are the one’s which are most likely to require the borrower to sign and date something or for the signing agent to notarize something.

Not all the pages, it will be random as in any refi. I was trying to convey that you will rarely see the need for signatures, dates or notarizations after the first 100 pages.

Sorry for the confusion.

Ok, but let’s not convey this to the TC or SC. Let’s just say OMG this is around 300 pages. It will take a long time ( and they will probably ask a lot of questions ) We’re going to need $300 for this one.

it sure was confusing

John I’m not certain what you feel we shouldn’t convey to Title Companies or Signing Agencies?

I primarily work only with title companies, and I can honestly say the Only time I’ve did a HECM was at the request of a Signing Agency. On the occasions when I did accept a signing from a Signing Agency, they weren’t forth coming and said this is a reverse mortgage, nor could they say exactly how many pages were in the packet…because most of the times they didn’t have access to the docs at that moment.

But the fees for the vary- I’ve gotten $200-$250 but never less.

Thanks

Thanks for your input. Actually my post was " more of tongue in cheek " a little levity for the holidays.

If a Reverse Mortgage is anything like a bankruptcy, then the signers have been educated in more ways than one about the deal they are signing for. Reverse Mortgages are not bankruptcies, however, the education process for the customer is exactly the same. By time they need to sign on the dotted line, they are ready to sign and get you out their door. If they have any questions, make sure you tell them to contact their account reps. You are not there to educate them on anything.

My first RM was 250 pages so 500 pages (one ream) to print documents and it took me 2 hours to get it signed because I wanted to be sure we didn’t miss any signatures and then borrowers had a few questions on a few forms and they had to call their LO. Even though I had checked for missed signatures or initials I was checking the package that night before dropping off at fed ex I still missed their signature on one page of the Uniform Residential Application. I went back the next morning to get it signed so when you go back immediately before sending off the loan package it saves you time and money. I have done 4 RM and all have different page quantity, but more than 180 pages on average. you cant ever be too careful when it comes to these loans. Once you get a few under your belt they become a lot easier.

Just a comment here about the counseling for RMs - my own experience - counseling was a 10 minute phone call, speakerphone so “counselor” could speak with both my husband and myself; VERY little education about the process, the docs, the mechanics, etc etc - it was basically “is this your primary residence?”, “what are your dates of birth?”, “okay, you’re good to go”. Had I not been in the business and been familiar with the program it could have been a problem - I basically educated my husband as did our loan officer (he was a local guy and we met with him in person).

I can honestly say I’ve never had a 200 page RM - 125-140 maybe but never 200; I’ve also had some that were 75-80 pages (those were sweet).

JME

Agree that the ‘paid’ counseling seems to be a joke, but the signers all seem to have been well-educated by their LO. Except (sometimes) for 2 or 3 very important things: 1. If you later decide to sell the property, YES, the RM must be paid off at time of sale. 2. If your current spouse is not ON the RM, they MAY have to pay it off when you die/vacate. (Altho’, this situation has been rectified with newer RMs thru ‘forbearance’–I am NOT an authority on that but (3) do not think it applies if a person was single when they got the RM & later married).

I will also add that I’ve seen some folks with what I consider ‘strange ideas’ about RMs–which they have NOT asked or discussed with the LO or Counselor. One lady (I only had the final), kept insisting that she wanted to know the payment as she intended to pay it off. I had her call her LO with her question…and the signing was oooover. Another man who had no mortgage had the no/go idea that he could take out most of the value/equity, enjoy spending it AND deed the house to his son who he thought would then own it free & clear. Again, had him call his LO ‘about that’. LO quickly straightened him out with the result that the man refused to sign.

Couple other things…if you do the application signing, they prefer you also do the final. Sometimes it works out that way, sometimes it doesn’t. IME, they are large packages, but some lenders send one pkg. that looks to be humongous, until you realize that BOTH the docs to be signed AND the B’s copy are in it & you only print 1X. Also, it pays to negotiate ‘FULL FEE regardless of outcome’.

I have handled over 100 reverse mortgages. They are like refinances except the borrowers are putting their existing mortgage, if there is one, and maybe other types of debt under one mortgage that doesn’t get paid off until they pass away. The new mortgage is an ARM.

There are some serious caveats to this type of loan. They are still responsible for any repairs on the home as well as property taxes. If they fail to keep up with these, it is a default on the loan. If one of the owners on the loan ends up with an illness that puts them in rehab for longer than six months, it is a default on the loan. Many times these items are not made clear to the borrowers during the counseling process and a borrower will decide to read one of the documents and then confusion sets in and they will want you to explain everything to them, which you cannot do. You can save time by setting the document aside and then have them call the loan officer at the end to get all of their questions answered while you go through the package to check for missed signatures.

The package is one of the largest you will have to handle because there are 2 Notes and 2 Deed of Trusts with duplicate documents tied to each of these documents. This is because the department in Washington DC that has oversight for this type of loan requires an original copy to be sent to them. The package size averages around 250 pages, depending on the lender.

The most important thing to remember in this process is the borrowers. Many of these folks are getting to the age where their mental faculties are beginning to slow and they are making a life-changing decision by doing this so be prepared to take your time. Plan on an hour minimum and use patience. Larger packages means more money. Do it right and you will become one of the preferred notaries the lender will want to use.