Always has been, that’s where the profit comes in on the lower numbers!

What exactly is “some sort of profit”? Either the job makes money, breaks even or loses money. If $65.00 is losing money in your region , why in the world would you take the job?

Volume work only adds up if youre looking for tax breaks. In my opinion the more you take low paying jobs, the more money you lose. Its pretty simple math…

This is the common mistake most make. “Math” (and just looking at the number offered) does not dictate profit by itself, its how your business is structured and how you run it as well that plays the key role. “Some sort of profit” is just that, whether you make a dollar or $100 dollars on the job, it’s still a profit (no loss, no break even) that’s “math”. If your hell bent on making a certain profit on every job, then you are by all means also dictating your own work load. “Low paying job” and “profit” are both up to individual interpretation BASED on their business structure and how they run it, NOT by the number being offered. If you had a $65 loan mod that was 30 pages, walked 5 minutes up the block, and spent 15 minutes at the table, and didn’t make a “profit” then the “math” is your not running your business right. Now if you were looking to make your next car payment off the job, then there’s that “math,” but I wouldn’t expect you to be as busy as most others who are making “some sort of profit.” Also, on a side note, if your “region” is dictating YOUR business profit, then yes, your “math” will be all jacked up!

To my point, if you the notary don’t know what your break even point is, taking lower and lower paying jobs is like being on a treadmill. Not going anywhere and surely not making any money… cash flows might look ok but there’s no profit especially when the over saturated market dictates a very low fee… 62 dollar reverse mortgages with any travel just aren’t profitable for me no matter how many I take in a day.

I hear ya, A break even point only tells you what your profit/loss would be in numbers. Your own set “profit margin” (not dictated by anyone or anything other than yourself) tells you whether your making a profit or not based on your business structure, not just a number. If you are set on making 20% profit on every job, and you get a job where you won’t make that margin, obviously this will automatically implant in your mind its a low paying job. Me, I know what it costs me to do a particular job (which is different than a break even point) as each job is different expense/time wise, and ANYTHING I get above that is profit. I don’t “create” break even points for every single job based on the number offered individually, and I don’t have margins because of this. You mentioned volume… There are those “sticking to their fees/margins” and those accepting “low offers.” Assuming those accepting low offers wouldn’t be doing so for a loss/or break even, but making “some profit,” where’s the volume going to?

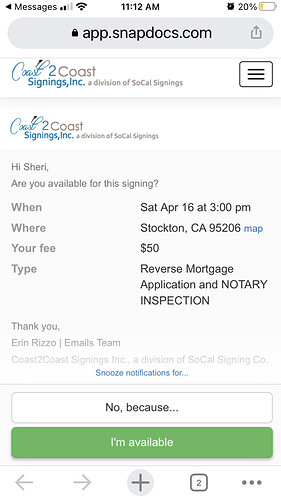

For a Reverse?! Oh Lord!

I can’t stop shaking my head!!! Wow and I thought $62 reverse mortgage from Closing exchange was insulting…

counter, or flat out reject the offer

And the profitability debate rages on. . .

I wonder why everybody tries to convince everybody else that they are or are not ‘profitable’. With all the variables in play, there is no right or wrong answer. No set formula will work for everyone. Golly, so many weighing in on whether they would take a job for $62 or skip it because gas costs too much. It seems to me, anyway, that none of us can learn much about profitability when each one’s circumstances differ so much from the rest of the pack.

I do wish you all well, though. In the meantime, I’ve reversed the game and decided to develop a “side hustle” of my own to fill in the $$$ blanks when notary business is slow. I’m going back to methods analysis to help small business achieve better “profitability”. Imagine that. . .

I’m not surprised. That’s why I fired them a year ago. If you are a season LSA you should be wasting your time with those SS companies. p.s. NotaryGo is another one and they are even worse. Good luck

What do they mean “notary inspection”??

$50 for an app was S.O.P. back in my time til I got wise and said “Nope, same fee as final signing and payable net 30, not at funding”

Ridiculousness! No clue what their thinking!

Your right @Bobby-CA. “Gas” seems to be a major deciding factor for most to determine if the “job is worth it” or not, and should be, but only if gas is actually NEEDED to get the job done. Not needing to burn gas, or putting wear/tear on ones vehicle SHOULD allow them to take a lower offer while still making a profit. If gas costs $4/gallon and one drove 3 miles to a job, and your car gets 24 miles per gallon, what did you actually spend on gas? I come up with 0.3 gallons of gas burned, resulting in $1 being spent total (on a 6 mile roundtrip). This is to enhance my previous statements on such, giving others something to consider when they see those so called “low ball offers.” So if someone is hell bent on “their fee” and does get $200 for that job 3 miles away on a car that has a 13 gallon tank, they could fill their tank out of that $150 while still profiting. As I was saying to @wbooker327, it’s not just the numbers and “math” that determines ones profitability, its their business operations (how they run it) that dictates/influences those numbers. Obviously, being fluent in math, economics and the industry itself also plays major factors in the numbers as well. I’m not trying to convince anyone of anything, and surely don’t present any formulas. Just sharing my experience with a splash of my 2 cents on how I come up with “math”

Yes it could be a small package ![]()

![]()

Yes, Coast to Coast, that with all their signing. #stayawayc2c

$65 sounds great compared to what I’m being offered. $50 for HELOC. 40 miles one way. $8.80 in tolls!

Have mercy! You win!

Boa helocs discover too need scan backs

I rarely see anything 5 minutes away. So last week a refi w scans 90 min each way plus a ferry$23

200 pages

$110.

Didnt take it