New data has revealed the extent HELOCs have grown this year as the popularity of refinances plunges in the current high interest-rate environment.

According to mortgage-industry data provider Attom, home equity line of credit volumes increased 6% in the first quarter this year versus the final three months of 2021, and 27.6% year-over-year to total 249,900. Over 62% of metropolitan areas reported HELOCs increasing from the fourth quarter, with consumers in Western markets, particularly, using them to tap into their home equity.

At the same time, refinances dropped 22% on a quarterly basis and 46% from one year ago in the first quarter to 1.45 million loans, the largest annual drop since 2014.

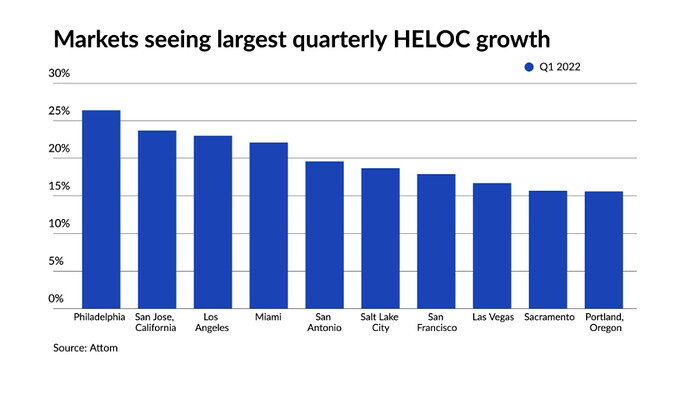

Among markets with populations of greater than 1 million, Philadelphia topped the nation in HELOC growth with 26.4% more volume generated in the first quarter compared to the three prior months. The majority of cities leading the list, though, were located in Sun Belt regions that also experienced the most rapid pace of increases in home values over the past year. San Jose, California, recorded 23.7% quarterly growth, followed by Los Angeles at 23%. Rounding out the top five cities were Miami, which saw 22.1% more HELOCs, and San Antonio with 19.6%.

6 Likes

That’s a great read here.

1 Like

I have been getting requests to do HELOC’s but they only want to pay $50.00. With the price of gas and the time involved that’s not worth it. Been counter offering but has not been accepted. They need to realize whether it’s 3 pages or 200 pages it takes the same amount of time and gas to get there and back and you still have to go to the FEDEX office to send the package.

8 Likes

(AZ) Wow… that is really low…what state are you in?

1 Like

The reason I posted this is to encourage everyone to reach out to their SS and TC to let them know that you can do HELOC closings. I called one of mine a week or so ago and was notified that they did not have HELOC checked on my availability. Since then I have gotten 3 in one week at my asking price.

4 Likes

Maryland -I’ve had quite a few of the $50.00 offers. Not worth it. Had a offer to do a Homeowner’s Agreement last Friday 10-14 pages for $40.00 from Notaries 24-7 Inc over the Snapdocs platform. These people are crazy.

2 Likes

(AZ) I can’t say I blame you… that is really lowballing.

1 Like

I’m not seeing an uptick in HELOCS in my corner of Texas. I suspect that the 80% equity value cap is keeping the lid on HELOCS. I am seeing a slight uptick on reverse mortgages. I’ve been told this is being driven by rising inflation impacting those on a fixed income.

3 Likes

Saw this coming (through history alone). The sad part is the worst is not here yet. Had a cash out REFI last week. They almost tripled their original interest rate (2.265 to 5.35%) and went from a 15 to a 30 year mortgage just to get $80k back.

1 Like

(AZ) In my area we have Military and a lot of retired VA’s. The refinance rates are still in the 4’s and 3’s what I am seeing.

1 Like

(OK) I’m seeing refi and HELOC rates at 2.5-5.6%. We also have a lot of Vets.

Yep! I did one today and she literally stated she had no other options but to do a reverse.

1 Like

Just got another request for a HELOC signing. Couldn’t remember who sent it when I posted earlier. They have been coming through Accurate Group, LLC and Citizens HELOC again for $50.00. I countered and don’t expect to hear anything back. Anyone have experience with Accurate Group. LLC?

I think the fee is low because it came from a SS. I fortunately currently working with zero SS. I am 100% working directly with banks, titles and investors only. No middle man at all. Thank God.

1 Like

Accurate Group normally do auto refinances which is why the amount maybe so low. Those are normally only 10-15 pages.

No matter how many pages you still have to drive there, drive back, scan and take the package to FEDEX. That still takes time and auto expenses and with gas so high you really don’t make any money.

2 Likes

I agree…I’m not saying $50 is ok. I’m just starting that might be one reason that particular signing started so low. Also it could be right next door to someone…

1 Like

I also got from them offerin $50. These folks don’t realize these have to closed in a law office (Texas requirement)

A Texas HELOC averages about 75 to 120 pages and has to be closed in a Law Office. It costs $50 to use the law offie.

(OK) I believe my response my regarding a standard auto refinance. I’ve never completed a Texas HELOC which is why I don’t comment about those  I’m glad Oklahoma does not have the same requirements. The majority of HELOC’s I’ve completed have been 30 pages or less and I’ve done a few that had up to 50-75 pages but they pay well over $50.

I’m glad Oklahoma does not have the same requirements. The majority of HELOC’s I’ve completed have been 30 pages or less and I’ve done a few that had up to 50-75 pages but they pay well over $50.

Anywho, I think this conversation is becoming more about what people think is an acceptable fee for others. I’ll step out of this one.

2 Likes